Galaxy Entertainment & Education - a prospected unicorn of TVS

Winning big from investing in Warburg-backed e-wallet MoMo, TVS and GEE ecosystem are eager to see the next unicorns of Vietnam.

Thien Viet Securities Joint Stock Company (TVS), one of the founding shareholders of Galaxy Entertainment & Education Platform (GEE), formerly known as Galaxy Group, has been vividly considered as a skilled "unicorn hatching machine" after Vietnam’s biggest e-wallet MoMo’s valuation reached over $2 billion. Besides MoMo, other companies receiving investments from TVS and GEE also have the prospect of becoming the next "unicorns" of Vietnam.

On December 21, Online Mobile Services Joint Stock Company (M-Service), the governing body of MoMo e-wallet, announced it had completed the 5th fund-raising round (Series E) after receiving the $200 million investment from global investors including Mizuho, Ward Ferry, Goodwater Capital, and Kora Management.

After the deal, M-Service's valuation reached $2.27 billion, qualified enough to become a tech “unicorn". With the attractive valuation, angel investors of the e-wallet were “over the moon”. Thien Viet Securities Joint Stock Company was among the investors.

In 2007, TVS injected VND27.85 billion ($1.2 million) into the startup. At the time, each share of it was valued at VND30,000 ($1.3) apiece. After the recent deal, the share price of M-Service jumped to VND2.5-2.8 million ($110-123). This means the TVS investment in MoMo has increased a hundredfold in just 14 years. As of June 30, 2021, TVS holds more than 918,414 common shares, equivalent to a 6% stake in M-Service. With a valuation of more than $2 billion, angel investor Thien Viet's assets at MoMo reached $120 million.

TVS share price jumps after MoMo became a “unicorn”

M-Service is an investment TVS Board of Directors is always proud of whenever talking about this tech startup. TVS share price began to jump since early 2021 when the e-wallet completed a Series D funding round with a $100-million investment. According to data from the stock market, since the beginning of 2021, TVS share price has increased by nearly 500%.

Recently, after MoMo became a "unicorn", the TVS share price of Thien Viet Securities, which was dubbed as a skilled "unicorn" incubator, kept increasing in 7 consecutive sessions (as of December 24), bringing the price range from VND46,000 ($2) to VND67,000 ($3). Liquidity spiked to nearly 500,000 to 1 million units per session.

M-Service is not alone. TVS is also an angel investor of a promising fintech company - Finhay Vietnam Joint Stock Company, the governing body of Finhay, a mobile application for financial investment. After investing in Finhay, TVS has helped Finhay improve its governance capacity and supported the startup in developing personal financial management products and services.

Besides TVS, Insignia Ventures Partners, and a number of investment funds, Finhay also received capital from foreign investor Jeffrey Cruttenden, cofounder of Acorns, which is a “unicorn” having a business model similar to Finhay and gained reputation in the US. The firm realized the potential of Finhay and fintech market in Vietnam.

Founded in 2017, Finhay is a mobile application that coaches users with a smart habit of accumulating, building and maintaining wealth. Its platform allows users to invest in portfolios allocated by their “appetite” from VND50,000 ($2.2). Currently, the platform has millions of registered accounts and hundreds of thousands of regular users.

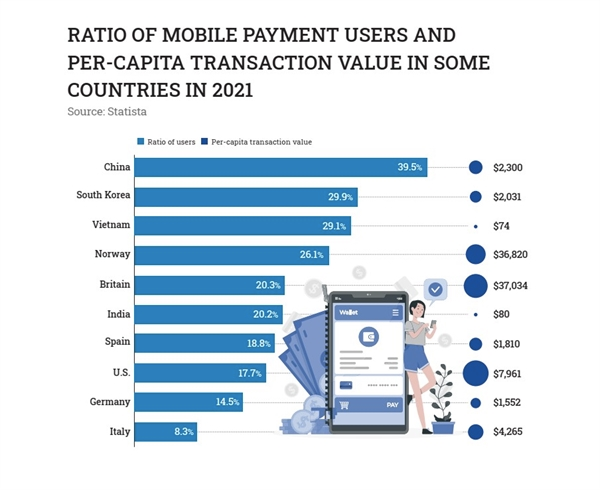

Finhay’s debut has marked a milestone in Vietnam’s booming fintech market, attracting foreign investors. According to reports from UOB Bank, auditing firm PwC Singapore and Singapore Fintech Association, Vietnam ranks third in the region in terms of attracting investment capital in fintech with $375 million, equivalent to more than 10% of the total value of capital invested in the region’s fintech. The amount was estimated at $3.5 billion, an all-time high.

Investing in Finhay is also part of TVS’s development strategy to diversify the financial services. With Finhay, the firm aims at young investors as well as the demands of optimizing the financial capacity of Vietnam’s growing middle class.

The breakthrough of Galaxy Play

Interestingly, TVS and GEE have the same founding team. They have solid financial and banking backgrounds and graduated from prestigious universities in Russia as well as Harvard (US). Galaxy Entertainment & Education Platform creates an ecosystem of film production (Galaxy Production), cinema - film distribution (Galaxy Studio), online movie platform (Galaxy Play), Galaxy Media, Galaxy Education, Galaxy Communications.

Inside GEE ecosystem, Galaxy Play has a pioneering role as Vietnam’s No.1 online movie platform. Since its inception in 2015, Galaxy Play has been constantly growing in revenue. In 2021, Galaxy Play’s revenue doubled after having more than 2 million new users. Currently, the platform has over 7 million users with 4.5 million users applying the cumulative paying method.

“We have the largest store of exclusive Vietnamese movies, which is always updated. In addition to the advanced technical platform, convenient and easy-to-use application, Galaxy Play has strengths in its content specially designed for Vietnamese audience. We aim to serve Vietnamese living in Vietnam and around the world,” said Luu Thanh Lan, General Director of Galaxy Play.

Thanks to the backing from Galaxy Production and Galaxy Studio, the largest film production and distribution companies in Vietnam, Galaxy Play holds the exclusive right to distribute online blockbusters including Dad, I’m Sorry, Face Off, Dreamy Eyes (Golden Lotus Award 2021)... and the upcoming movie project Em & Trinh is expected to make a big splash when it comes out in April 2022.

Since 2020, Galaxy Play has regularly produced exclusive series such as Sugar Daddy, Sugar Mommy, A Phoenix From The Ashes, Honey, We Need To Talk... With elaborate investment and content that closely follows the tastes of Vietnamese audience, Galaxy Play’s exclusive series is always at the top of the most-loved movies on the platform.

In order to successfully “hatch” a new “unicorn”, GEE will have to combine the ecosystems of both Galaxy Play and Galaxy Education, which have more than 10 million users. In 2015, Galaxy Play invested millions of US dollars to conduct research and develop its cloud and streaming infrastructure.

COVID-19 pandemic encourages people to stay at home. Work-from-home has brought a golden chance for the "home theatre" model to explode. The online movie market in Vietnam has been increasingly active. According to data from the Ministry of Information and Communications, in November 2020, there were about 35 enterprises providing online paid TV services with 14 million subscribers and total revenue of about VND9,000 billion ($395 million).

Investment funds have seen the COVID-19 pandemic as a screening tool for startup selection. Startups that can survive the pandemic will be potential and become bright candidates for attracting investment capital. Movie companies have actively adapted to the new situations with cinema closures by increasing online content services. History also proved that “unicorns” emerged and new promising startups appeared amid economic crises and recessions.

Will Vietnam’s first edtech "unicorn" appear?

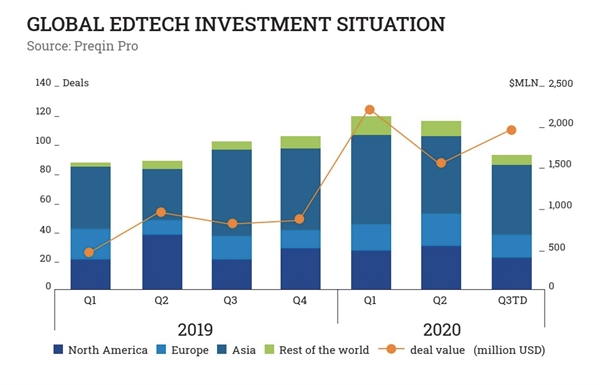

Besides e-commerce, logistics, e-payment, several other economic sectors are nurturing firms with a valuation of millions US dollars, an important foundation to become “unicorns”. The future “unicorn” will likely be a tech firm operating in the education sector and the pandemic will serve as a catalyst for the rapid growth of edtech.

Like TVS, GEE has ambitions in "incubating unicorns" when it has actively implemented digital transformation strategies in entertainment and education.

Investing in Hoc Mai was the first door for Galaxy Education to join the online education segment, focusing on all grades from preschool, high school to university, vocational training... Galaxy Education is a large online school that satisfies all education demands for people from 2-18 years old.

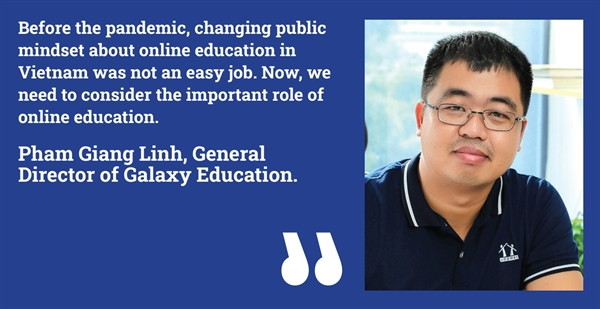

“Before the pandemic, changing public mindset about online education in Vietnam was not an easy job. Now, we need to consider the important role of online education. According to a survey result from the Ministry of Education and Training, more than 80% of schools nationwide have shifted to online education,” said Pham Giang Linh, General Director of Galaxy Education.

During the past 2 years, the number of Galaxy Education’s users soared impressively with a 200% growth. Especially, the number of paid users increased by more than 100%. The online education platform is the leader of Vietnam’s online education market. The platform has more than 5.5 million users, 3 times higher than its second-ranked competitor.

What are the signals that Galaxy Education could become a new "tech unicorn" in the future? Galaxy Education plays a dominant role in a market with over 200 participating companies. The startup has an ambitious goal in driving user growth and commercial revenue growth to serve all Vietnamese learners.

In addition, the online education platform has a comprehensive learning ecosystem with several products, cross-platform, from online to face-to-face for learners from 2 to 18 years old. The firm has clear branding, marketing, and content strategies. Galaxy Education is the leading startup with 15 years of experience in online education, especially in the general education segment.

The market of Galaxy Education and other edtech companies is huge. Vietnam has more than 17 million high school students, 5 million preschool children, and more than 1.7 million university students. Clients of edtech companies range from kindergarten children to adults. Vietnam is currently among the top 10 edtech markets with the fastest growing pace in the world, at 44.3% in 2018.

According to Ken Research, Vietnam's edtech market value could reach $3 billion by 2023. Thanks to the high rate of internet and mobile phone penetration, the country is considered an ideal location for new edtech models to emerge and develop in the region. Having quickly realized these potentials, several foreign firms made their debut in Vietnam such as Duolingo, Age of Learning, Ruangguru, upGrad and Snapask...

According to experts, the growth potential of Vietnam's edtech market matches with the common development trajectory of Asia. Besides China and India, the two large markets in the region, Southeast Asia is considered as a potential market with favourable conditions for edtech to develop thanks to its young population, rapid economic growth, high rate of internet and mobile phone penetration. It can be explained why investments in edtech in Vietnam have boomed in recent years.

EQuest Education Group revealed it had received $100 million investment from a major investment firm in the world. CoderSchool, a Vietnamese online startup training computer programming, has announced it received a $2.6 million investment in Pre-series A funding round led by Monk's Hill Ventures Fund. Marathon also successfully raised $1.5 million in a Pre-seed round from Forge Ventures, Venturra Discovery, iSeed, and other angel investors. Educa received $2 million from ReDefine Capital in Series A round. English learning app ELSA attracted the most investment with $15 million in Series B funding round co-led by Vietnam Investments Group and SIG. Overall, ELSA raised a total of $27 million.

“To maintain position in the market, we strongly invested in technology. The Hoc Mai (lifelong learning) system in the Galaxy ecosystem has a role to build programs, learning content. Through big data and artificial intelligence, the system helps identify the demands of users to improve the effectiveness of self-study. We are confident to build a leading edtech platform in Vietnam”, affirmed Pham Giang Linh.

Vietnam’s edtech market is waiting for large investments and some startups in this business to become new unicorns. This has been the trend in several markets around the world. Nikkei Asian Review has mentioned several emerging names in this area such as FPT, KiddiHub, EQuest, ELSA... to affirm the great potential of online education. Foreign investors have begun injecting capital into the online education sector. With a leading technology platform and large ecosystem, Galaxy Education is also a leading name that is attracting special attention from international investors.

Thanks to the trade war, Vietnam is receiving a wave of investment from abroad due to an abundant source of low cost labour. American companies tend to move production out of China. The Southeast Asian economy is facing the risk of falling into the middle-income trap. In order to overcome this challenge, its workforce should be trained thoroughly and of course, online education is being prioritized by the government. The Vietnamese government has set a target of providing online education in 90% of universities and 80% of high schools and vocational training institutions by 2030.

Vietnamese people are also increasingly interested in education. According to the General Statistics Office, annual per-capita spending on education increased 2.3 times in a decade to about $304 in 2020. However, Nikkei noted that infrastructure could be a drawback for online education in Vietnam when internet connectivity is still restricted in rural areas.

A dream of 10 “unicorns”

In Southeast Asia, several reputable names have been in the list of unicorns, namely Bukalapak, Go-Jek, Traveloka, Tokopedia of Indonesia; Malaysia's Grab; Lazada, Razer, SEA (Garena) of Singapore...

The appearance of second-generation unicorns in Vietnam like MoMo has supported the goal to have 10 unicorns in the next 10 years. After the first-generation startup which has hit the unicorn threshold like VNG, the second generation of unicorns like Finhay and GEE are expected to appear.

The goal to have 10 tech unicorns in Vietnam is difficult but it’s entirely possible. Vietnam's startup ecosystem has grown, said Addie Thai, Director of the 500 Startups Vietnam, adding that his fund needs to change strategy to catch up with the new business trend.

After the boom of tech startups, several are entering the mature stage, especially those operating in 3 areas of financial technology (fintech), education technology (edtech), and medical technology (healthtech). They are expected to contribute to the completion of the startup ecosystem with 10 tech unicorns in the next 10 years.

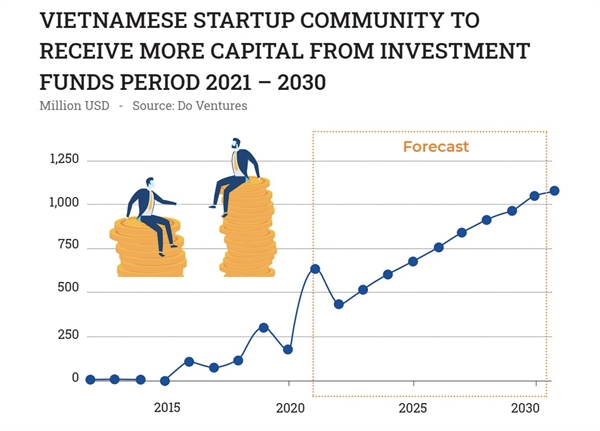

It can be seen that the startup community in Vietnam is standing on a fairly solid tripod: policy, human resources, and capital. The government created favorable conditions for startups to develop. The support from startup investment sources of investment funds, investment banks, famous financial institutions became a catalyst for startups to turn into “unicorns”.

Vietnam also has an advantage in resources with young talents. Vietnamese software engineers are considered the top in Southeast Asia... According to Blink in 2020, the Vietnamese startup ecosystem is ranked 59th in the world. In the Asia-Pacific region alone, Vietnam's innovative startup ecosystem is in the top 20.

Vietnam did not have a new unicorn in several years. But in only 2 years 2020 - 2021, the country has 2 unicorns in a row 2020 (VNPay), 2021 (MoMo), showing that there will be more unicorns in the Vietnamese startup market.

In a specific perspective, consulting firm YCP Solidiance predicts that the transaction value of the fintech sector in Vietnam will reach $22 billion by 2025, compared to $9 billion in 2019. In fact, a series of brands such as MFast, Toss, VNPay... have announced their business expansion strategies in both Vietnamese and Southeast Asian markets, after several millions of US dollars were injected into fintech.

Vietnam's digital economy is ranked third in the region in terms of capital attraction, with $600 million between 2018 and the first half of 2019. In 2019, the number of investment deals dropped, but the investment value jumped. Investment deals in MoMo, Sen Do, Topica... from international investors have contributed to making Vietnam an attractive investment destination.

By the end of the decade, more startups in Southeast Asia will emerge. The annual number of initial public offerings in the region is expected to surpass 300 by 2030. Among them, Vietnam is considered a "rising star" of the region and will emerge as the third-largest startup ecosystem in Southeast Asia, predicted Golden Gate Ventures. Vietnam has great hope of having new unicorns after VNG, MoMo. They could be Tiki, Topica, Sen Do, Finhay, GEE, making the dream of having 10 unicorns in 10 years come true.

When it comes to technology development, it is impossible to ignore the role of angel investors. In Vietnam, there are 180 active investment funds, namely VSV Capital - Vietnam Silicon Valley, Nextrans, Mekong Capital, Vietnam Investments Group, 500 Startups Vietnam, IDG Ventures Vietnam. They are willing to help transform startups into new unicorns.

“Vietnam is one of the most attractive investment destinations in the region. In the coming years, investors will focus heavily on three areas including financial technology (fintech), education technology (edtech) and health technology (healthtech). Nurturing startups in these exciting fields to become unicorns like MoMo is also our goal as well as many investment funds,” said Nguyen Thanh Thao, General Director of TVS.

Nguồn: https://e.nhipcaudautu.vn/companies/gee--a-prospected-unicorn-of-tvs-3343573/